Inside the Budget, Part 1: Revenues

How the City Budget Works: The first in a series of blog posts explaining where our money comes from, how it is used, and what sort of rules we have to follow. I hope this will help you understand the budget process as well as how we deliver services to our residents—which, after all, is what the budget is for!

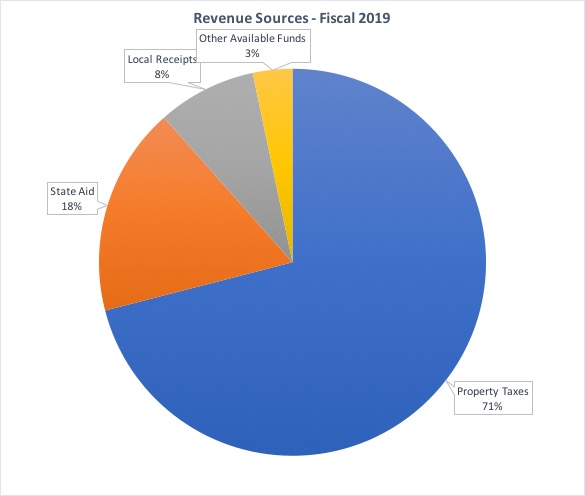

I thought it would be appropriate to start with a look at where the money comes from. All the numbers here are projections and may change as the fiscal year goes on, but this is what we work with to build the budget.

- Property Taxes account for 71% of our operating budget, about $59 million.

- State Aid is the second largest revenue source; it is projected to be about $14.5 million in FY 2019. Some of that returns to the state in the form of assessments for charter school tuition, MBTA assessment, and other items.

- Local Receipts, which make up 8% of the budget, are things like excise taxes on cars, building permit fees, parking fines, and other monies that residents (and non-residents) pay to the city. The total dollar amount of local receipts in FY 2019 is projected to be $6.8 million.

- Other Funding Sources includes things like parking fees, perpetual care fees for Wyoming Cemetery, and indirect costs from our enterprise funds. (I’ll explain this further in a future post, but briefly, water, sewer, Mount Hood, and the city-run ambulance have their own separate budgets, called enterprise funds.) The total from Other Funding Sources in FY 2019 is about $2.7 million.

It’s clear that property taxes are the foundation of our city budget. Proposition 2 1/2 says that we can only raise the total amount of property taxes by 2.5% per year, plus the value of new growth. Here’s that calculation:

Current Tax Levy: $55 million

2.5% Increase: $1.4 million

New Growth (estimated): $400,000

In addition, the debt exclusion override for the new middle school, passed by Melrose voters in 2003 adds just under $2 million to the total. When the debt is paid off, in 2029, this will no longer be included in your tax bill.

Adding all these up, total property tax revenues for Fiscal 2019 come to a little over $59 million.

It’s important to note that while property values have been rising in Melrose, taxes do not rise as fast. The total amount we can collect is dictated by Proposition 2 1/2, and we can’t go over that amount. So when the property values go up, the tax rate goes down so total taxes don’t exceed the Prop 2 1/2 cap. Stay tuned for a future blog post that will explain Proposition 2 1/2 in more detail.